NIA chief reaches Pahalgam as probe intensifies into terror attack

The Director General (DG) of the National Investigation Agency (NIA), Sadanand Date, reach ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . India will identify, trace, punish every terrorist and their backers: PM Modi on Pahalgam attack

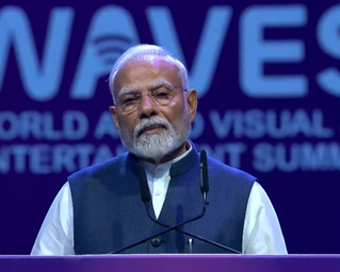

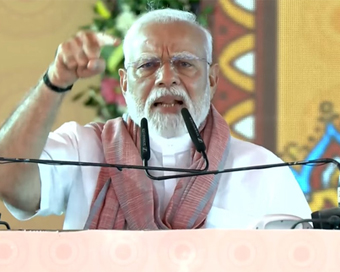

Prime Minister Narendra Modi on Thursday issued a powerful warning to the "enemies" of the ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Pahalgam terror attack was masterminded by Pakistan, says CWC resolution

The Congress Working Committee (CWC) on Thursday strongly condemned the dastardly terror a ... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .