Gallery

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

RTGS to become functional round the clock from today Last Updated : 14 Dec 2020 10:10:42 AM IST

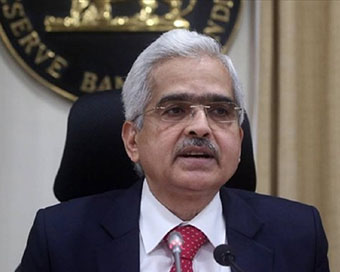

RBI Governor Shaktikanta Das The Real Time Gross Settlement System (RTGS) for high-value transactions will be available round-the-clock from today, making India one of the few countries in the world to operate the system 24X7.

RBI Governor Shaktikanta Das had announced in October that the system will be available at all times from December 2020 to make online fund transfer smooth."This comes within a year of operationalising NEFT24x7 by the Reserve Bank," the RBI said in a statement.The settlement system began its operations on March 26, 2004 with a soft launch involving four banks, presently handles 6.35 lakh transactions daily for a value of Rs 4.17 lakh crore across 237 participant banks."The average ticket size for RTGS in November 2020 was Rs 57.96 lakh making it a truly large value payment system," the statement said."Round the clock availability of RTGS will provide extended flexibility to businesses for effecting payments and will enable introduction of additional settlement cycles in ancillary payment systems.""This can also be leveraged to enhance operations of Indian financial markets and cross-border payments."IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186