PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)The Badminton Association of India (BAI) has announced a 14-member-strong India squad for

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

- Djokovic, Alcaraz land in same half of Miami draw

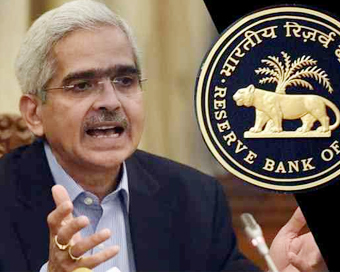

RBI turns accommodative: Reduces lending rates to boost growth Last Updated : 06 Jun 2019 12:43:48 PM IST

RBI turns accommodative Home and auto loans are set to become cheaper as the Reserve Bank of India (RBI) on Thursday lowered its key lending rate for commercial banks by 25 basis points (bps) to 5.75 per cent.

Besides, the RBI changed the monetary policy stance from neutral to accommodative.

The decision to reduce the repo rate was taken by the RBI's Monetary Policy Committee (MPC) at its second monetary policy review of the current fiscal.

As per the monetary policy statement, the main considerations behind the MPC's decision were the decline in private final consumption expenditure (PFCE) and moderation in exports.

Currently, high interest rates and liquidity constraints have demoralised auto, home and capital goods buyers. Even the high frequency indicators suggest moderation in activity in the service sector.

Accordingly, a lower repo, or short-term lending rate for commercial banks, will reduce interest cost on automobile and home loans, thereby ushering in growth.

This is the the third reduction in repo rate during 2019. The RBI in April lowered its key lending rate by 25 basis points (bps) to 6 per cent. Before that, in February, the MPC had voted to lower the repo rate by 25 bps to 6.25 per cent.

IANS Mumbai For Latest Updates Please-

Join us on

Follow us on

172.31.16.186